RiskWatch offers over 50 prebuilt content libraries that are ready for use in our platform. These libraries contain industry standards and regulations, lending subject matter expertise and guidance for organizations. Achieving compliance with these libraries ensures risk is minimized.

Compliance Software For Financial Services

Secure Your Data, Comply with Confidence with Our RiskWatch GDPR compliance software

Everything you need to achieve and maintain compliance for Financial Serivces

Improved protection of high-value, theft-prone goods

Reduction of security threats and liability risks

Increased awareness of possible dangers

Competitive advantages from transparency and trust

The Challenges

Financial institutions grapple with a host of intricate challenges when it comes to maintaining regulatory compliance. These challenges include:

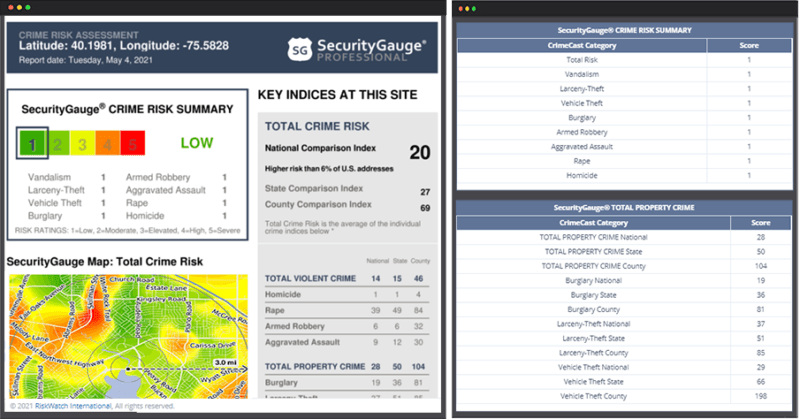

Risk Assessment and Prioritization: Financial professionals face the daunting task of ranking risks. Identifying which areas pose the highest risk to data security, privacy, and financial stability is crucial. However, this process can be complex due to the dynamic nature of financial markets.

Detailed Reporting: Accurate and comprehensive reporting is essential for regulatory compliance. Financial organizations must create detailed reports based on individual and collective data from various operations. These reports serve as evidence of adherence to industry standards and legal requirements.

Resource Allocation Decisions: Allocating resources effectively to address compliance gaps is a constant challenge. Balancing preventive measures, incident response, and ongoing compliance efforts requires strategic planning. Misallocation of resources can lead to vulnerabilities.

Navigating Evolving Regulations: The financial landscape is ever-changing, with new regulations and guidelines emerging regularly. Staying abreast of these changes and ensuring alignment with evolving compliance standards demands vigilance.

Data Security and Privacy: Safeguarding sensitive financial data is paramount. Compliance teams must grapple with securing customer information, preventing data breaches, and adhering to privacy laws.

The Impact

The consequences of failing to comply with financial regulations are far-reaching:

Exposure and Reputation Damage: Organizations that neglect compliance risk exposure to legal penalties, financial losses, and reputational damage. News of non-compliance spreads swiftly, eroding trust among clients and investors.

Operational Disruptions: Non-compliance disrupts business operations. Regulatory investigations, fines, and corrective actions divert resources and attention away from core functions.

Legal Penalties: Regulatory bodies impose hefty fines for violations. These penalties can cripple financial institutions financially and tarnish their standing in the industry.

Loss of Market Confidence: Investors and customers lose confidence in non-compliant institutions. This loss of trust affects market share, stock prices, and overall growth.

Real-Life Example: Consider the case of Purvis Home Improvement Co. in the financial sector. In a parallel to the physical security example, imagine a financial institution failing to adhere to anti-money laundering (AML) regulations. The consequences could be severe fines, legal battles, and a damaged reputation.

In summary, non-compliance in financial services jeopardizes stability, trust, and growth. Prioritizing compliance ensures a resilient financial ecosystem.

Achieve your Compliance Goals with RiskWatch

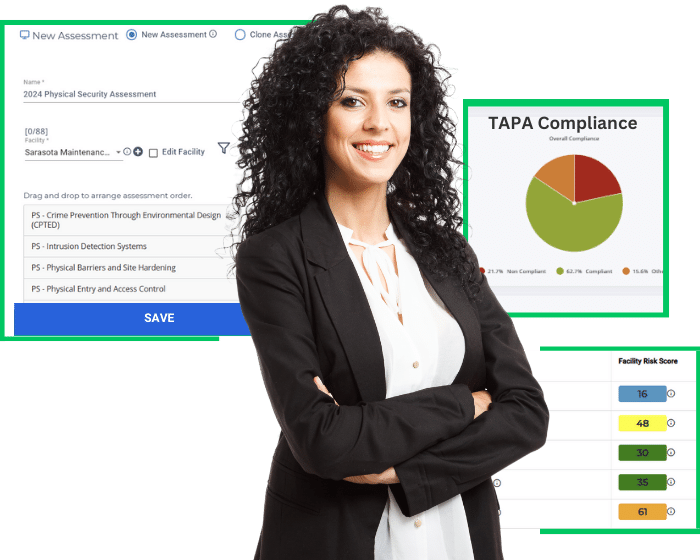

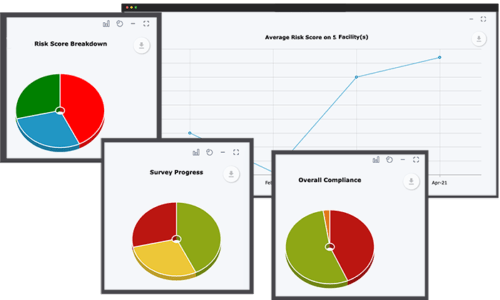

Automated Analysis

- Automatically rank sites by risk to prioritize mitigation.

- Understand security at a glance with real-time dashboard analytics.

- 80% time savings when assessments were conducted using previous assessments performed in SecureWatch and compared to a manual assessment process.

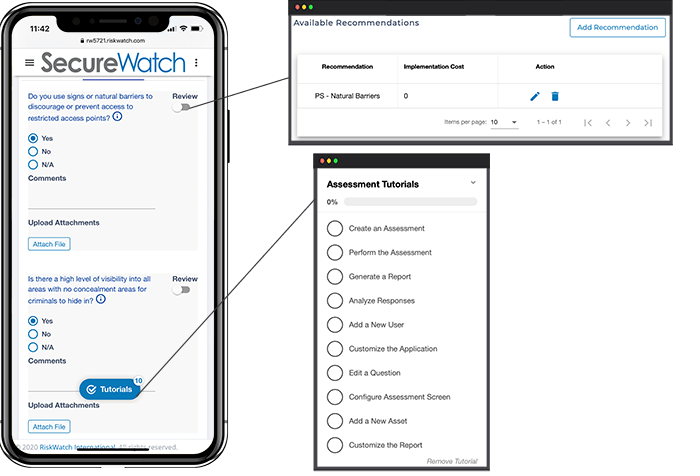

Streamlined Assessments

- Increase efficiency by an average of 74% compared to a manual process.

- Replace subjective analysis with objective criteria in a defined and structured process.

- Repeat and reuse assessment data, recommendations, or tasks in your next assessment

Pre-built Content Libraries

- Additional content libraries can be added to assessments with a single click.

- Reduce unnecessary costs by eliminating the need for third-party expertise.

- Custom libraries and any standard or regulation not already available can be created.

Can You Afford Non-compliance?

ABN Amro: Fined €480 million for money laundering failures, exposing gaps in risk identification and reporting3

Ready to get started and automate your compliance process?

RiskWatch platform is easy to use, free to try, and can be customized to fit your business needs.

FAQs

No. There is not a charge for an inactive user and previously assessed assets do not require new licenses unless you perform a new assessment.

Your level of support depends on the package you purchased with your product (Essentials, Standard, or Enterprise). Click here to see our support levels

No. Our platforms are browser-based and can be used on any device that has a web browser and internet connection.

Get started quickly and easily- we set up and host your software site for you. No servers, no storage, no maintenance.

Additional Licenses, Standards, and Service can be added to Standard and Enterprise Subscriptions.

Platforms are licensed by the number of active users on a monthly or annual basis. Click here for a closer look at our pricing structure.

No. Your software will automatically update to the latest versions for no additional charge.

We provide an iOS and Android app that can be used to perform assessments offline.